The Negotiable Instruments Act, 1881, is an Indian legislation that governs the use of negotiable instruments in financial transactions. The Act provides the framework for the creation, transfer, and enforcement of negotiable instruments such as promissory notes, bills of exchange, and cheques. Here are some key aspects of the Act:

Key Provisions

1. Types of Negotiable Instruments:

– Promissory Notes: A written promise to pay a certain amount to a specific person or bearer.

– Bills of Exchange: A written order from one person to another to pay a specified amount to a third party.

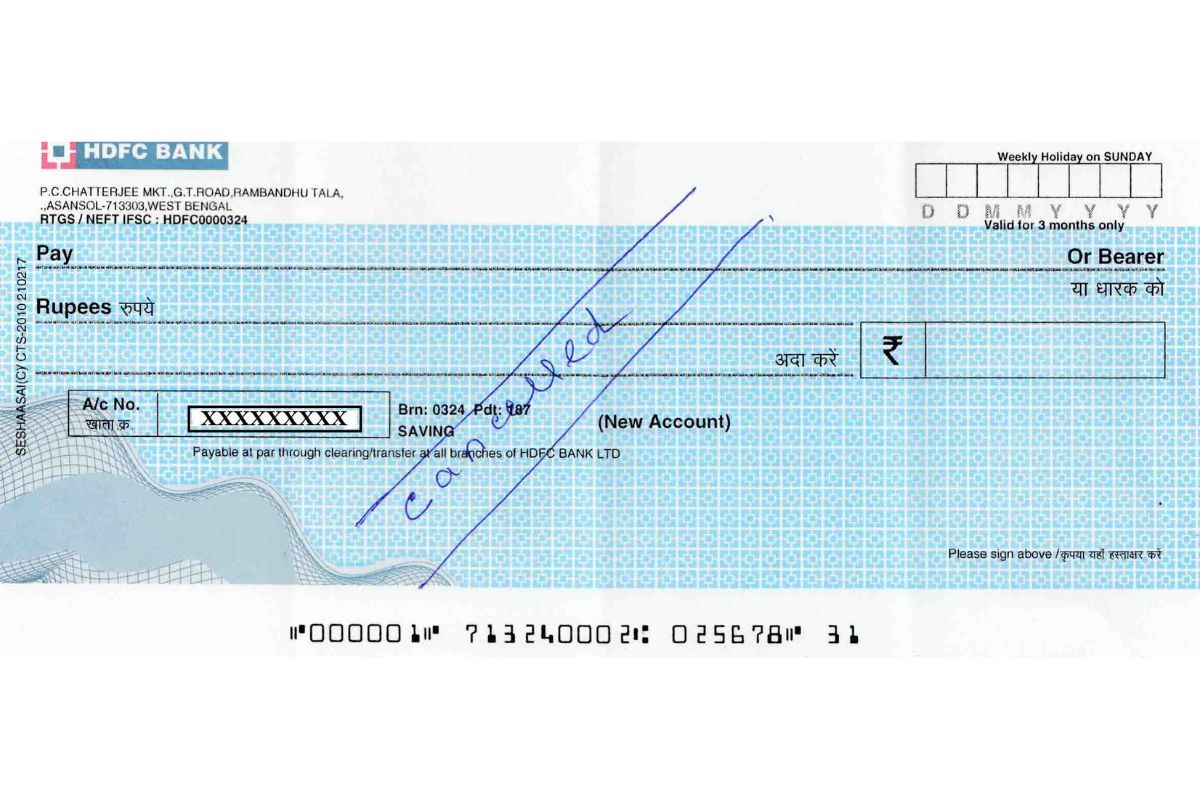

– Cheques: A specific type of bill of exchange used for transferring money.

2. Negotiability:

– Instruments are transferable by endorsement or delivery, which means they can be passed from one person to another, and the transferee acquires the rights of the original holder.

3. Holder in Due Course:

– This refers to a person who has acquired a negotiable instrument for value, in good faith, and without notice of any defects. Such holders have certain protections under the Act.

4. Dishonour of Instruments:

– The Act addresses the consequences of dishonour, i.e., when a negotiable instrument is not paid or accepted when due. This includes provisions for criminal and civil remedies.

5. Liabilities:

– The Act defines the liabilities of the parties involved in the negotiable instruments, including the drawer, drawee, and endorser.

6. Legal Recourse:

– The Act provides for legal recourse in cases of dishonour of cheques, including criminal proceedings under Section 138 for dishonoured cheques due to insufficient funds.

Importance

– Regulation: It standardizes the practice of using negotiable instruments in financial transactions, ensuring clarity and consistency.

– Dispute Resolution: Provides mechanisms for resolving disputes related to dishonoured instruments, thus facilitating smoother financial transactions.

– Protection: Offers legal protection to holders and parties involved in the transfer of negotiable instruments.

Overall, the Negotiable Instruments Act plays a crucial role in regulating financial transactions and ensuring the smooth functioning of credit and payment systems in India.